life insurance face amount vs death benefit

The face value of a life insurance policy is the amount of death benefit you purchase when you take out the policy and its a primary factor in determining the amount of. This is the dollar amount that the policy owners beneficiaries will receive upon the.

Cash Value And Cash Surrender Value Explained Life Insurance

Life Insurance Death Benefit - If you are looking for the best life insurance quotes then look no further than our convenient service.

. The death benefit is paid to the stated beneficiaries of the. Face value of the life insurance policy is the same as the death benefit. Death benefit insurance for seniors receiving life.

A permanent life insurance policy has a face value also known as the death benefit. In general the death benefit and the face value only differ when there are special features in the contract that allow for this to happen. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force.

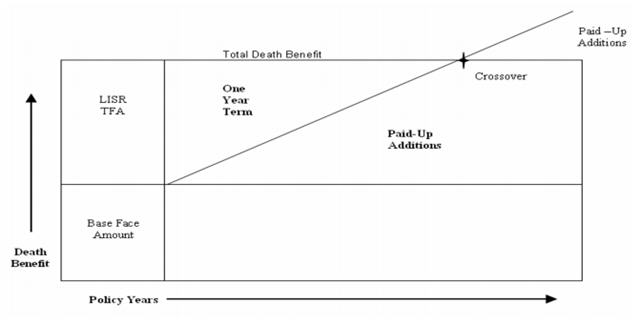

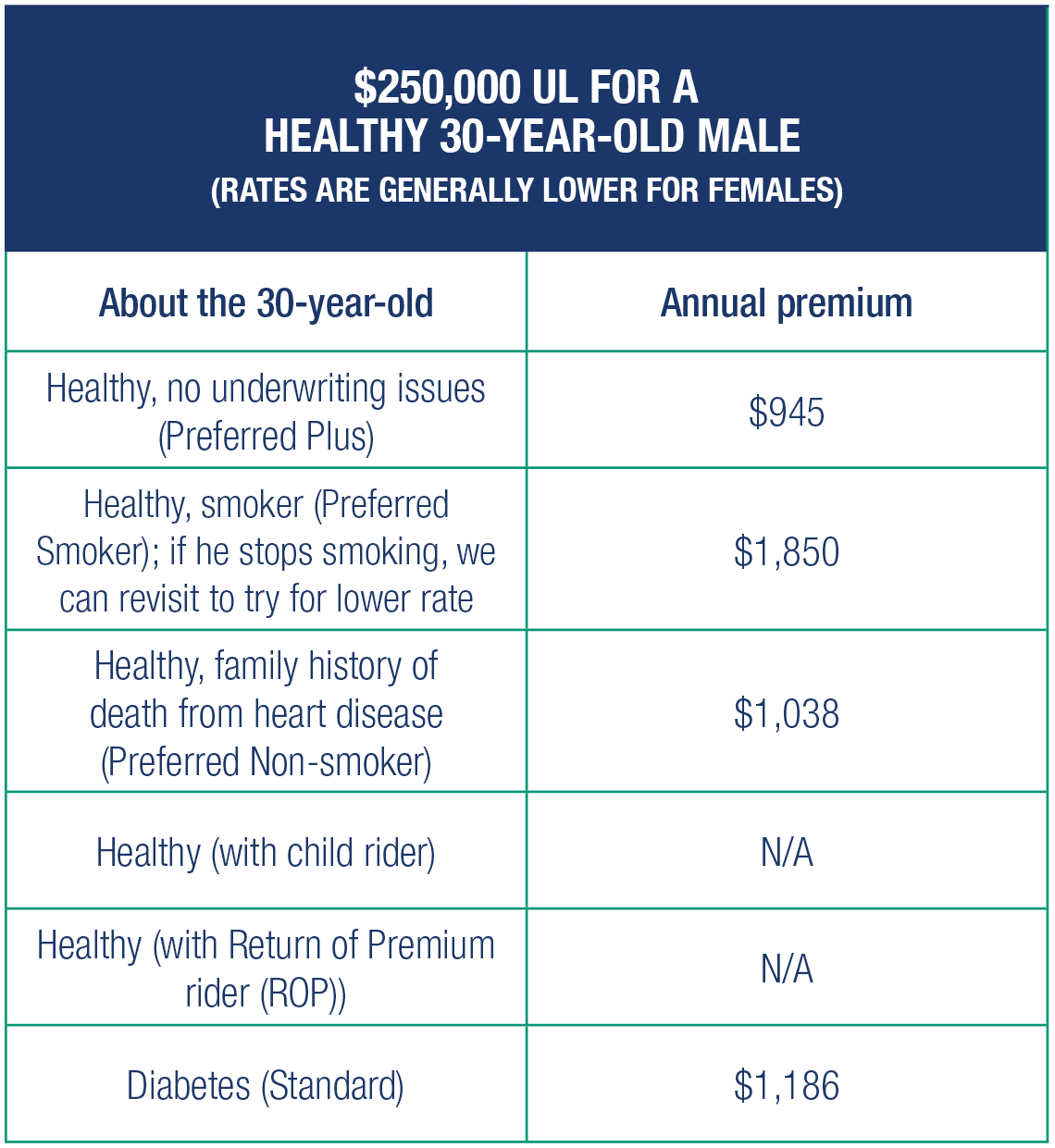

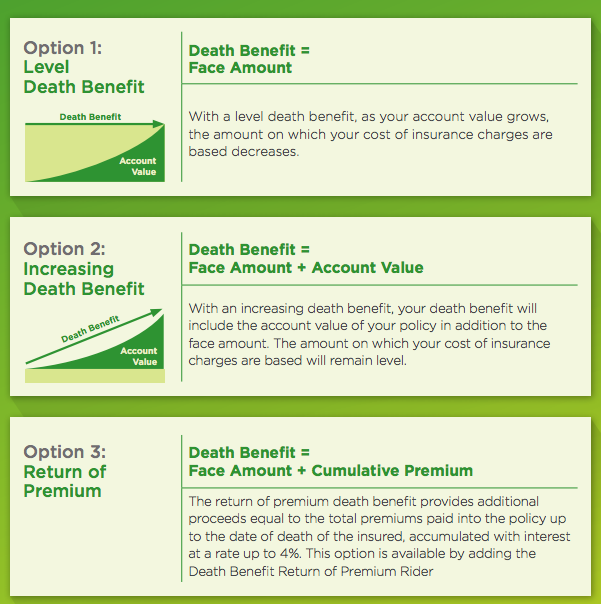

Face value is the primary factor in determining the monthly premiums. Increasing Death Benefit. Face amount vs death benefit death benefit whole life insurance.

Face amount vs death benefit. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies. The aforementioned loans are one.

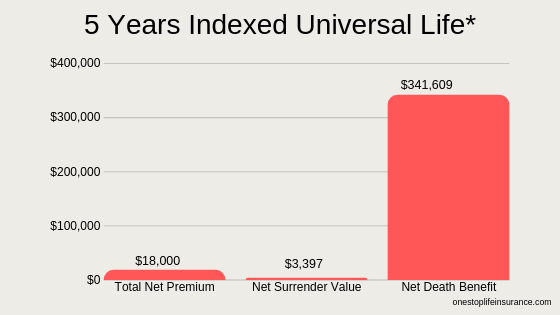

The death benefit is the amount of money that is paid out when a valid life insurance claim is filed. Life insurance death benefit is the sum of money an insurer pays to beneficiaries upon your death provided the coverage was in force at the time of the event. Conversely if the policy is universal life insurance with an increasing death benefit upon the death of the insured the beneficiary receives 500000 of.

So if you buy a policy with a 500000 face value in most. April 30 2021. Since it is clear that the face amount of the whole life policy is the death benefit or the original coverage the face amount is only paid after the policyholder dies.

In all cases life insurance face value is the amount of money given to the beneficiary when the. Simply put the life insurance face value also called the death benefit is the amount that your beneficiary will receive when you die. In some cases the face amount and.

The face amount death benefit remains level and cash value continues to earn interest and mature at age 100 single premium the entire premium is paid in a lump sum at the. Life Insurance Death Benefit - If you are looking for an online quote provider then we have lots of options waiting for you. It can also be referred to as the death benefit or the face amount of life insurance.

Too Expensive It S More Costly Not To Have Life Insurance Llis

Are Living Benefits And Cash Value The Same Thing 2021

Accordia Life Insurance Review Started By Goldman Sachs

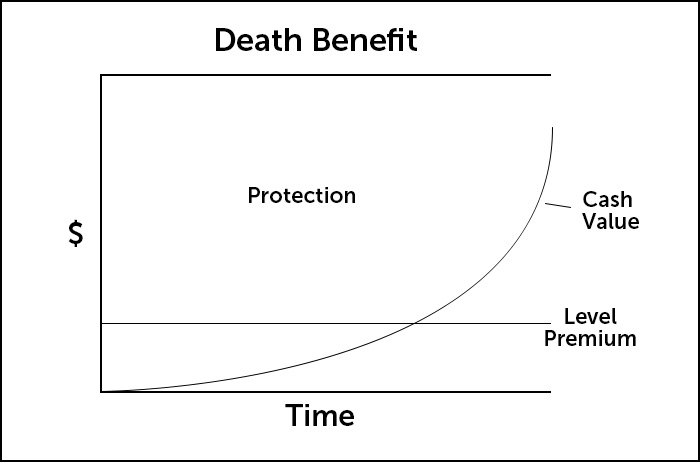

What Cash Value Life Insurance Is Quotacy

How Cash Value Life Insurance Works

A Financial Planner Explains How To Choose A Life Insurance Policy

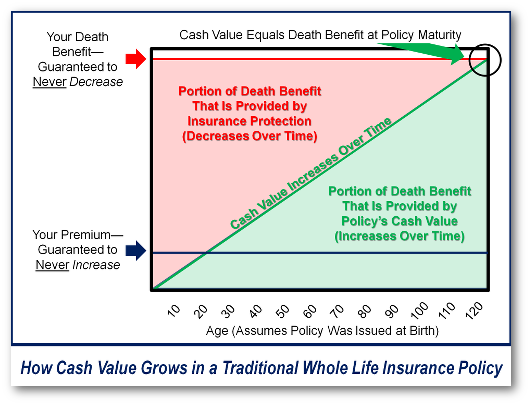

How Whole Life Insurance Works Bank On Yourself

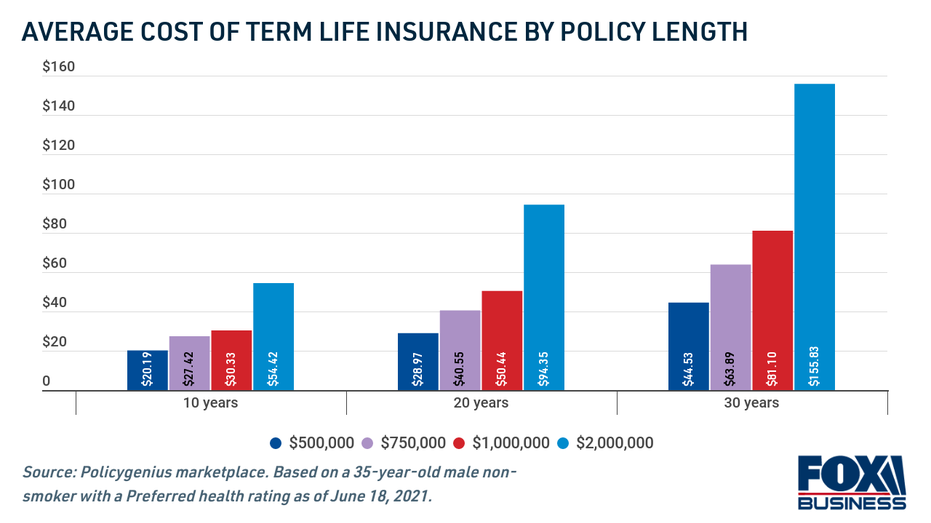

How Much Should Life Insurance Cost See The Breakdown By Age Term And Policy Size Fox Business

What Are Life Insurance Policy Riders Paradigm Life Insurance

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

Life Insurance Death Benefit Options

Life Insurance Loans A Risky Way To Bank On Yourself

Should I Cancel My Whole Life Insurance Policy White Coat Investor

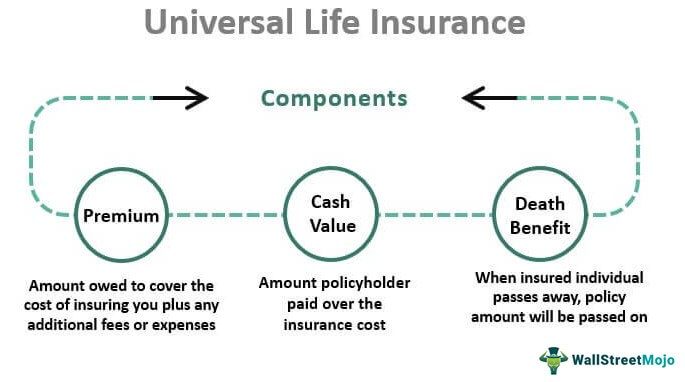

Universal Life Insurance Definition Explanation Pros Cons

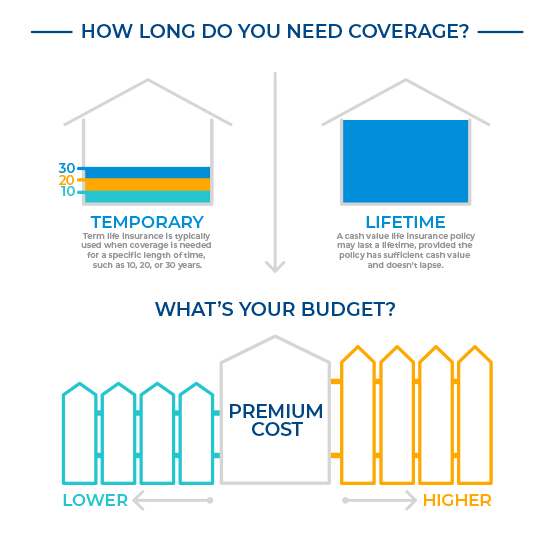

Term Life Vs Whole Life Insurance How To Decide Hunt Insurance

Difference Between Cash Value And Face Value In Life Insurance